When is the last time you looked at your sales and use taxes…

When we bring up the subject of Sales and Use Taxes to prospective clients, the top three responses we get are:“We don’t pay sales tax.” “We have that handled.” “Our Accounting Firm handles that.” STS offers professional high level sales and use tax services which could save your company hundreds of thousands of dollars, both historically and in the future. All companies are great at what they do, but may be unable to keep up with all the weekly and daily opportunistic sales tax court cases, which may create huge savings for your company. Most companies set up their accounting controls and processes years ago, but the landscape is changing every day. Your reliable CPA, mainly focuses upon your income taxes and financial accounting issues, possibly leaving one of your most costly areas undetected. Paying attention to the finite sales and use tax codes is what we do.

Read MoreTestimonials

– Brian Laufenberg, IH Miss Valley CU

Early Client Praise

– Connie McKean, Key Auto Mall

– Mike Nelson, Nelson Brothers Agency

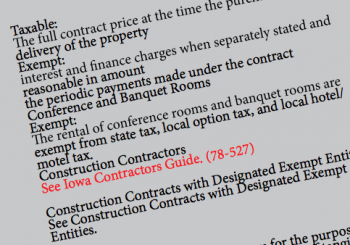

Mining the Fine Print of the Tax Code

The fact is, most states’ sales tax codes are ambiguously written for good reasons, the codes create a lack of certainty on the tax-ability of an item. A legislative body decides it needs revenue and drafts a bill to that effect, however, sometimes legislature...

Read More

Big Money in Small Print

The amount we save varies by company, of course, but it’s usually significant, often reaching into the six figures. Our typical contingency fee engagement keeps us in business doing what we love (leveling the playing field between taxpayers and the state reven...

Read More

Sales Tax Solutions’ Pay for Performance Agreement

Our clients love our compensation agreement. Why so popular? It’s easy to understand. It is risk free and 100% confidential. Here’s how it works: You allow us access to a select amount of records currently in your office, show us where to work, and give us a f...

Read More